Most people don’t give themselves enough credit in being able to positively influence their portfolio’s performance. Sure, the world of investments is nuanced, but embracing one of the basic principles of personal finance can tilt the scales in your favor tremendously. The principle I’m referring to is lower costs means more money in your pocket. I understand that’s not terribly groundbreaking. However, in the investments arena, where compound interest is at stake, the annual cost you pay for investments has a more substantial impact on your financial well-being than you may realize.

First and foremost, it may come as a surprise to some that we pay annual fees for the investment funds we hold. Even if you’re aware of these annual fees, you probably haven’t thought much of them in the past. Well, for the remainder of this blog, allow me to build a case for why your investment fees are worth paying attention to, and propose a simple approach for enhancing your portfolio’s performance.

The Power of Half a Percent

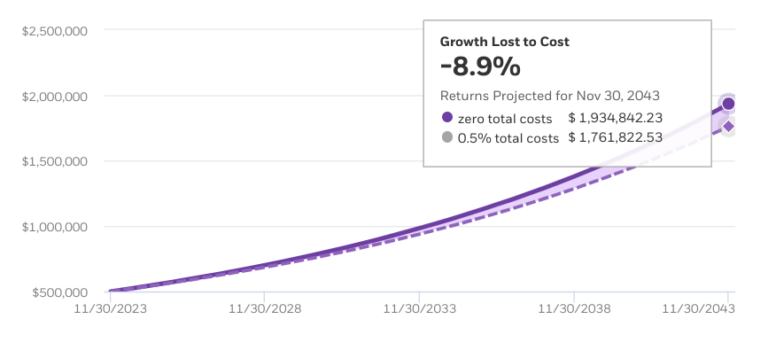

Let me start with a splashy, yet realistic example. Imagine we have two investors with seemingly identical portfolios. Both investors have $500,000 in a growth-oriented investment fund that returns 7% each year. The only difference between them is that one investor is mindful of fees, and chose a fund that charges a half a percent less per year.

It’s no surprise that the “fee-conscious” investor will end up with more money. The shock and awe comes in understanding the impact a mere half percent can have on your financial trajectory. By making a one-time decision to utilize a fund with a lower annual fee, the mindful investor creates cost savings within their portfolio each year. In turn, this increases the compound interest their portfolio produces each year.

As a result, the fee-conscious investor would have $173,019 more in their portfolio after 20 years. That’s an additional value of 35% relative to their original investment. This higher portfolio value would allow the fee-conscious investor to take roughly $276,000 more from their portfolio over a thirty year retirement compared to the “fee-ignorant” investor. I think both investors would agree that’s a fairly significant difference in lifestyle derived from a seemingly insignificant half percent.

The purpose of this example is to illustrate the surprising impact a few tenths of a percent can have on your financial well-being. The concept itself is easy enough to understand. The less you pay in annual fees, the more money that remains invested and compounding on your behalf. And when it comes to compounding, little dollars add up to big dollars. Also worth noting, the larger the portfolio, the more value you’re able to create through fee reductions. For example, if we were to double the initial portfolio balance of both investors to a million dollars, the value created through a half a percent fee reduction would also be doubled to $346,038.

So, the question now becomes, ‘How do I reduce my annual investment fees without having to become an investment guru?’ The first step in reducing your fees is understanding the fees you’re being charged. So, let’s start there.

Your Investments & Their Fees

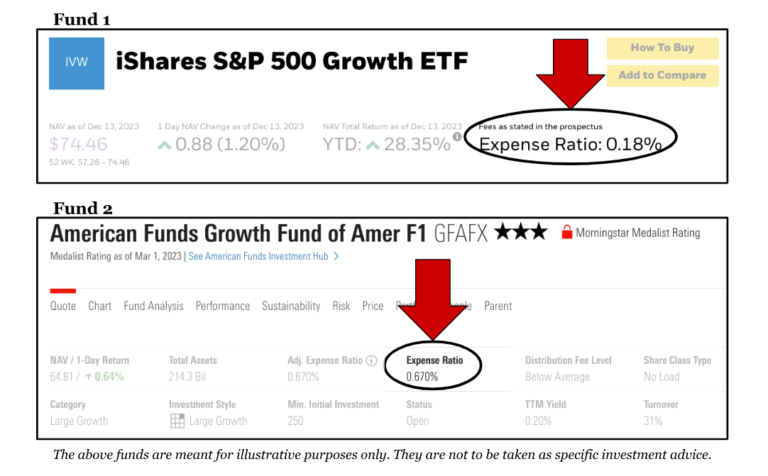

Today, the majority of individual investors opt for investment funds because of their convenience. By purchasing a single fund you can gain a diversified investment stake in dozens, if not hundreds, of companies that are all bundled together under a single ticker. However, as we know, financial institutions don’t offer the convenience of these funds out of the goodness of their heart. Investment funds charge an annual fee known as an expense ratio. Expense ratios are expressed in percentages, and are listed in the fund’s summary / prospectus. This percentage represents the portion of your investment’s value that will be deducted for fees each year.

The two investments shown above are perfect examples of funds that occupy a very similar space, but have dramatically different annual costs. Both are US-centric, growth-oriented investment funds. At any given time they’re likely to hold positions in many of the same companies. However, a $500,000 position in Fund 1 would cost an investor $900 per year. Whereas the same position in Fund 2 would cost $3,350 per year. The amount paid each year would theoretically grow as your investment increases in value over time. In those terms, it’s easy to see how the annual fee savings can add up, and compound quite quickly.

A key question arises regarding the differences between these two funds. The primary difference is that Fund 2 employs a team of professionals who trade in and out of positions in hopes of providing higher returns to the fund’s investors. Due to this active management style, the fund incurs higher costs, which leads them to charge a higher expense ratio.

An argument can be made that a team of professional investors aiming to achieve higher returns will offset the additional cost for the fund, but history points to the opposite. Historical return data shows that only *9% of actively-managed funds beat the returns of the S&P 500 over a ten year period. Meaning in 91% of cases an investor would be better off holding the low-cost, passive index fund as opposed to paying the higher fees of actively-managed funds.The underlying math dictates that it’s simply hard to compete with keeping more dollars invested when compound interest is at play.

Despite where you are in your wealth accumulation journey, the opportunity presented by reducing your annual investment costs is meaningful. It’s some of the lowest hanging fruit we have for generating additional value using our existing asset base. While these marginal cost differences may not seem all that significant in the moment, the fact is that every dollar that leaves or remains in your portfolio swings the pendulum of your financial trajectory.

Going forward, I encourage you to think about your portfolio’s fees in terms of annual dollars. The difference of a half percent in annual fees on a one million dollar portfolio is $5,000 each and every year. As we now know, the annual compounding of that cost savings can lead to drastically different lifestyles for seemingly identical investors. It all comes down to how much emphasis you’re willing to put on a few tenths of a percent.

*The investment return data referenced in this blog is taken from Forbes.com