Will your appetite for activity and adventure be the same at age 65 and 85? One can certainly hope, but the honest answer is probably not. Just like in life, retirement has its progressions. Naturally, in the early years we’re energized and eager to make the most of our newfound lifestyle flexibility. Once we’ve sewed some wild oats, we’re happy to embrace a slower pace. It shouldn’t be asking too much to have your retirement income ebb and flow with your lifestyle shifts. Yet without thoughtful oversight, your retirement plan may assume you’ll be just as active at 85 as you were at 65.

Traditional retirement withdrawal strategies often adhere to a “level income” approach that fails to reflect the realities of how retirees actually wish to spend over time. These strategies tend to impose a flat income throughout retirement, ignoring the natural progression of spending patterns. As mentioned, early retirement years are typically marked by higher discretionary spending, as retirees seek to travel and pursue hobbies. However, Morningstar Research finds that a retiree’s annual spending naturally decreases by approximately 1% per year throughout retirement. Meaning, from age 65 to 85 the average retiree spends roughly 20% less on discretionary purchases.

This gradual decline underscores the idea that retirees don’t necessarily require a flat income stream over time. By clinging to a level-income model, traditional strategies miss the opportunity to optimize income for the most active and adventurous years, leaving retirees with a plan that doesn’t actually align with their desired lifestyle.

More Money Upfront

Alternatively, frontloading retirement income is a strategic approach that allocates additional funds during the early years of retirement, when retirees are typically at their healthiest and most active. This strategy is designed to provide more “walking-around money” during the phase of life when you’re best positioned to enjoy it. By shifting resources to these early years, frontloading aims to maximize the utility of retirement income, enabling greater flexibility when the desire and ability for discretionary spending are at their peak.

Another advantage of frontloading is its customability. It’s ultimately up to you to decide how much additional income you’d like to receive, and how many years the elevated income period should last. Perhaps you envision an additional $10,000 per year for the first five years to be used towards travel. Frontloading opens the door to a conversation around more specific lifestyle goals we hope to achieve during the initial phase of our retirement. It also serves as a source of encouragement to actually pursue the activities that were previously constrained by work schedules.

Trade-Offs

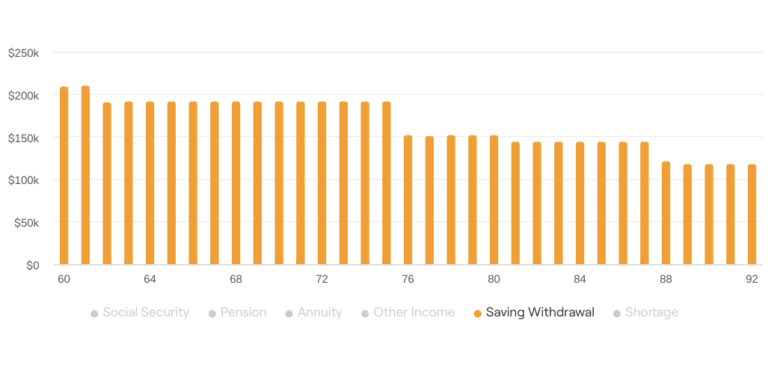

As with all things in life, there is a tradeoff that comes with frontloading. The goal is ultimately to provide more income early on, which means that the same level of income will likely not be available later on in retirement. Essentially, we are creating spending phases where, in order to enjoy more income in earlier phases, we have to be willing to accept lesser income during later phases. Finding the correct balance for each of these phases requires a good bit of thought, and is best executed with the help of a Certified Financial Planner who can stress-test and guide your plan.

Understandably, frontloading will vary in its level of attractiveness depending on individual preferences. However, the core idea is that retirees have more flexibility in their retirement income than they may be aware of. Being handed a retirement plan that imposes a level-income approach might not optimally support your vision for retirement, and generally doesn’t align with the research surrounding spending progressions. From a planner’s perspective, frontloading is yet another lever we have to better align a client’s plan with their goals. It’s an opportunity to deliver additional lifestyle flexibility at a time when you’re best positioned to enjoy it.