When it comes to saving for retirement, conventional wisdom would lead us to believe that 403b’s are essentially the same as 401k’s. In fact, even the financial planning community tends to think of these accounts as interchangeable. Both these plans provide employees with the opportunity to invest for retirement in a very tax-efficient manner. This tax-efficiency allows compound interest to be maximized, which makes them powerful wealth builders. While the shared similarities are wonderful, the seemingly negligible differences between them carry far more significance than initially meets the eye. As a financial planner who actively seeks out the most efficient investment options for clients, I eventually came across a 403b plan that left me completely baffled. It sent me down a 403b rabbit hole from which I have not yet fully emerged. Coincidentally, this saga wasn’t sparked by a client inquiry. Instead, it started much closer to home.

Something's Up

In the fall of 2018 my fiance, Leigh, started her first full-time position as a fifth grade teacher in the New York public school system. Before the school year started she attended a new teacher orientation. I can recall her mentioning that she would have both a pension, and the option to contribute to a 403b. After the initial mayhem that comes with the start of each school year had subsided, I encouraged her to find out more about starting contributions to the school’s 403b plan. She noted that there were financial advisors that were frequently at the school that she could talk to. My highlevel (borderline lazy) advice was to “make sure you ask about account fees, and let the advisor know you want passive low-cost investments.”

I’ll spare the details of the back and forth between the advisor and Leigh, then back to me, then back to the advisor. I’ll also skip over the ambiguous explanations Leigh received regarding her account fees. The abridged version is that we later found out Leigh’s initial contributions were going towards a tax-sheltered annuity. As someone who knows investments, this was a preposterous choice for someone of her age and risk tolerance. Furthermore, Leigh’s account fees were being craftily disguised on her statements, and were more than double what the advisor had been quoting her all along. Angry but more so defeated, I encouraged her to pay the hefty surrender charge, and switch to the school’s other 403b provider. Thinking we were out of the woods, the second provider’s annual fees were lower. However, they were still three to five times higher than what I had historically paid in 401k’s. At this point, I was left in a state of wrath and bewilderment. ‘How are these companies getting away with these absurd fees and practices?’ Once I stopped seeing red, I started researching.

403b's - The Wild West of Retirement Plans

As a part of my job, I’m well informed on the regulatory and ethical standards all retirement plans must meet. I knew that there are regulations in place that ensure that plans provide suitable and affordable investment options. I also knew that true financial advisors are held to the Fiduciary standard, which means they must act in the best interest of their clients at all times. With that in mind, all signs pointed to one or both of these protections having broken down.

All retirement plans are governed by a regulation known as ERISA. As mentioned, ERISA ensures that employers are providing suitable investment options in their retirement plans. However, for some seemingly unknown reason, 403b plans for public K-12 schools are exempt from following ERISA guidelines. Herein lies the subtle yet massive difference between 401k’s and public school 403b’s. This essentially means that the first layer of investor protection does not apply to these plans. Additionally, without ERISA adherence, these “financial advisors” who could be more aptly described as investment salesmen, have far lower ethical standards to meet when giving investment advice.

Tip: Never be afraid to ask a financial advisor if they are a Fiduciary.

The removal of these two layers of investor protection creates the perfect conditions for high-commission, high-fee annuity companies to thrive in. The fact that this issue has not yet been addressed at the Federal level remains a mystery. But, even if we were to set the lack of regulation and lower ethical standards aside, certain industry players felt the need to go a step further. In July of 2022 fraud charges were filed against Equitable Advisors (formerly AXA) accusing the company of providing misleading account statements for approximately 1.4 million variable annuity investors, mainly school teachers and school staff. The charges centered around the company giving investors the false impression that their quarterly statements listed all fees paid during the period. The findings showed that Equitable’s account statements typically listed account fees of $0.00. Equitable settled the case for fifty million dollars in a matter of days, and admitted no wrong-doing. Take a wild guess where Leigh’s first 403b account was held.

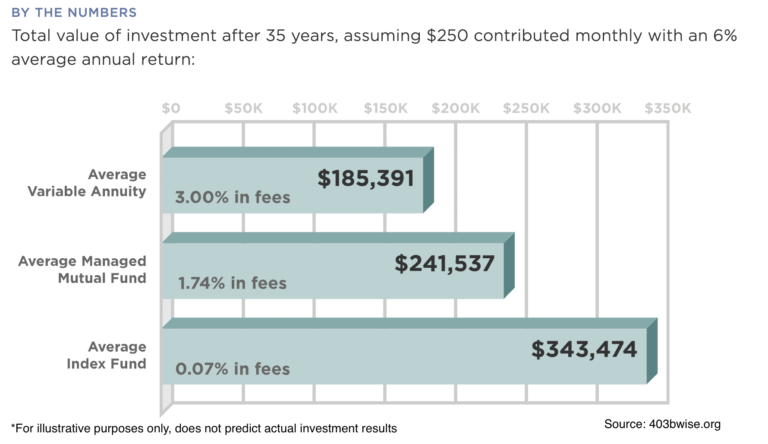

The bottom line here is that our teachers deserve better. As someone who both cares for and will be impacted by a teacher’s ability to effectively save for retirement, the absurdity of the situation is infuriating. While anger towards certain advisors is likely warranted in many cases, it doesn’t move the ball forward. The core objective that I would encourage teachers to keep front of mind is minimizing their account fees. Annual account fees of 2 – 4% are simply way too high, and will continuously diminish the growth potential of your retirement savings. High account fees are like running a marathon with ankle weights on. It can be done, but you have to work that much harder to get to the finish line. Below is an example illustrating the impact various fee levels can have on the ending balance of an investment portfolio.

What's a teacher to do?

Despite the fact that employer plans are often the most convenient option for building a retirement nest egg, they are by no means the only option. The first step should be to determine exactly what you’re paying in annual fees by reviewing your plan summary. Oftentimes, the plan summary can be found online in your client portal. Don’t go to your statements because, as we now know, companies can mask their fees by taking them directly from investment gains. If it’s determined that you’re paying more than 1% it’s worth exploring different avenues in my opinion. Those different avenues could be changing your investment allocation to lower-cost investments. Or halting contributions all together, and finding other retirement savings vehicles. Other retirement vehicles would include 457 plans, Traditional IRAs, and Roth IRAs. These accounts allow for tax-efficient retirement savings just like a 403b or 401k, but often carry annual fees lower than 0.5%.

For those who currently have substantial savings already invested in a 403b, the same fee assessment process should be done. While you may be disappointed to find out how much you’ve been paying in fees, the silver lining is that there is always something that can be done. At the very least, have the opportunity to reallocate into cheaper investments, change to another 403b / 457 plan, or move the investments into an IRA if you leave your job. This could come with a surrender charge, and that will be an important consideration. However, by moving your investments you would likely lower your account fees going forward, continue to benefit from tax-efficiency, and give you or an advisor of your choice full investment control. For those approaching or on the cusp of retirement, all of these options remain available to you, but these decisions will likely carry more weight. It’s perhaps worth speaking to a financial planner, in which case ‘Are you a Fiduciary?’ should be your first question.

The world of retirement saving and investing is what you make of it. Remember that you are ultimately the steward of your own wealth, so the more you know the better off you will be. It can seem intimidating to get started, and I’m sure your 403b financial advisor will be the first to tell you how complicated it is. Believe me, it’s not nearly as complex as some will make it out to be.

After seeing all the time, energy, and money that Leigh has put into being an amazing teacher, I have been disheartened by the lack of transparency in the 403b world. However, I have also come across personal accounts, and communities of teachers who have created extremely positive change within their districts. Based on what I can see, awareness among teachers and regulators is growing. With several teachers among my friends and family I have already begun sounding the 403b alarm, and I encourage you to do the same. If you are interested in learning more about 403b’s or retirement savings in general, I would encourage you to check out the resources listed below, which I have found extremely helpful throughout the process.

403b Wise – Excellent Starting Point For More Information

Learned By Being Burned – In Depth Podcast On The Experiences & Solutions Of Other Teachers

School District Plan Rating – Learn About Your District’s Plans & Their Ratings