Ah retirement–the period in life best known for some well-deserved leisure and relaxation. At some point we’ve all caught ourselves thinking about the flexibility and adventures we’ll have once we’ve stepped away from working life. The million dollar question (sometimes quite literally) is how much flexibility will we have, and how extravagant will our adventures be?

Taking place under the surface of every successful retirement plan is a tightrope walk. Where on the one hand, we’d like to enjoy as much of our nestegg as possible to create the highest quality lifestyle for ourselves. On the other hand, we can’t overindulge to the point that we’re living in fear of diminishing our accounts too early. These two notions highlight the balancing act each of us attempts when planning for our retirement income.

Creating Retirement Paychecks

Retirement income planning centers around creating retirement paychecks for ourselves. Some of those paychecks will be fixed, and come from guaranteed sources like Social Security or pensions. Because these paychecks are fixed and guaranteed, there tends to be very little uncertainty when planning for that portion of our retirement income.

While fixed income remains an important pillar in retirement, now more than ever retirees are relying on monthly withdrawals from their nestegg to fund the majority of their lifestyle. Adding some complexity, is the fact that there’s nothing fixed or guaranteed when it comes to your portfolio value over time. In some sense this reframes our initial question of ‘how much can we safely spend’, into ‘how much can we safely withdraw from our nestegg each year.’

Pro's & Con's of the 4% Safe Withdrawal Rate

The 4% safe withdrawal rate is far and away the most widely referenced nestegg withdrawal strategy, and for good reason. In the early 1990’s, an industrious Certified Financial Planner named Bill Bengen took it upon himself to find a “worry-free” withdrawal strategy. Using historical market data, Bengen determined that there has never been a 30 year period in market history where a 4% annual withdrawal rate would have led to a retiree fully diminishing their portfolio. Hence it’s naming of the 4% safe withdrawal rate.

Implementing his strategy is fairly straightforward. Let’s say a sample couple is about to retire with a one million dollar nestegg. The first year’s total withdrawal from their portfolio would be 4%, or $40,000. Each subsequent year they would increase their withdrawals by the rate of inflation in order to maintain their spending power. Voila! They have a perfectly viable withdrawal strategy.

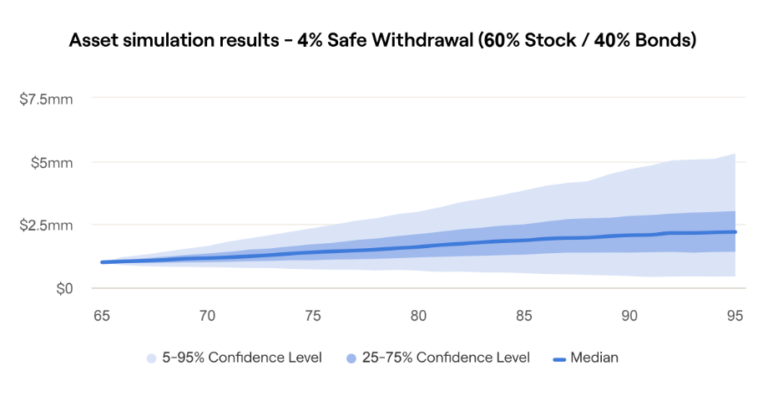

Bengen’s strategy serves as a great jumping off point to arrive at a conservative estimate of how much we can safely take from your nestegg. However, it can also lead to a significant and often overlooked pitfall. The magic behind the 4% withdrawal strategy is that it’s meant to withstand the worst possible market conditions on record. But what if you don’t happen to retire during one of those historically bad periods? What if instead you experience some degree of normal market returns throughout your retirement?

When running an asset simulation using the 4% safe withdrawal rate, we tend to see an upward trajectory where retirees end up with close to, if not more than double what they had initially started retirement with. That may sound fantastic in theory, but for our sample couple it means a lot of high quality life experience was left on the table. The fear of diminishing their portfolio ultimately led to an overly conservative retirement lifestyle.

Dynamic Withdrawal Strategies

A withdrawal strategy that allows for the couple to react to their portfolio’s performance over time tends to strike a better balance. In other words, if their portfolio is performing well during retirement, they can afford to withdraw more. If their portfolio is underperforming during a given period, they’ll need to cut back. Similar to bumpers on a bowling lane, a dynamic withdrawal strategy would consistently keep the couple on a sustainable path.

A crucial element of this type of withdrawal strategy is the fact that they are willing to accept a potential income reduction in times of market turmoil. By moving away from the rigidness of a static withdrawal strategy, like the 4% rule, they unlock a new degree of flexibility for their retirement income. The upside of making this concession is that it allows for substantially more nestegg income throughout their retirement.

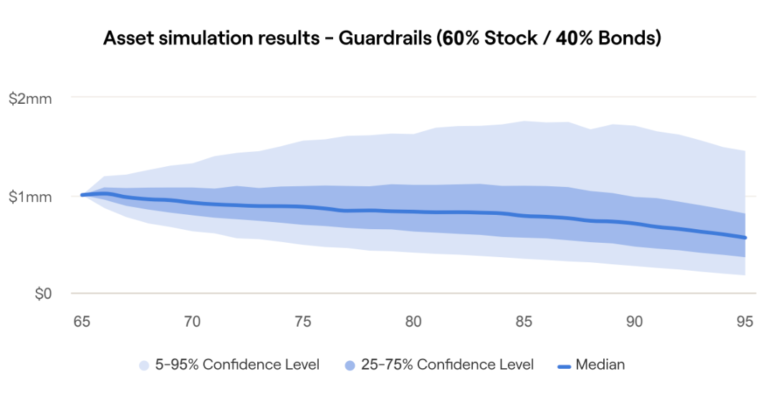

When embracing a dynamic strategy, they can actually start retirement with a significantly higher annual withdrawal rate. With their one million dollar portfolio, they could safely begin their retirement at a withdrawal rate closer to 6%. In dollars that translates to $60,000 per year, representing a 50% increase in income compared to the 4% strategy.

Establishing Safeguards

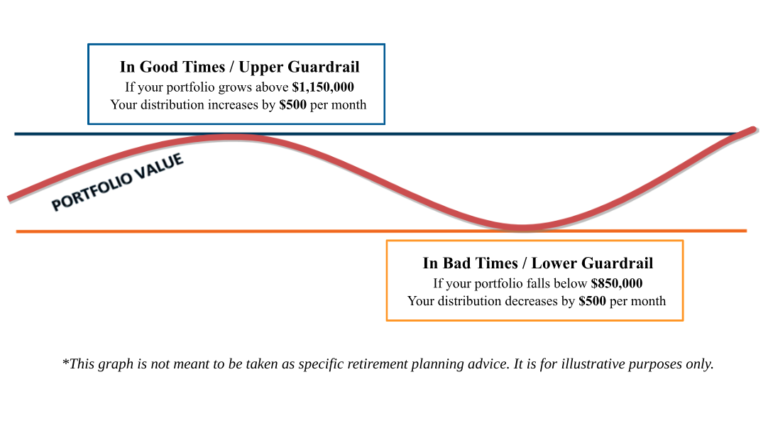

Once the initial withdrawal rate has been determined, we want to establish safeguards to ensure the couple is neither underspending or overspending at any given time. These safeguards are known as Guardrails, and act as the bowling lane bumpers for the couple’s retirement. Both an upper and lower guardrail would be established to act as indicators for when the couple should change their withdrawals. The Upper Guardrail is established by determining a hypothetical portfolio value where their nestegg could sustainably provide an additional $500 of income each month. The Lower Guardrail is established by determining a hypothetical portfolio value where their current rate of withdrawal is no longer sustainable, which triggers a $500 reduction. As the couple ages, the Guardrails would be reassessed to ensure they are staying on track and getting the most out of their nestegg.

Utilizing a dynamic strategy provides the couple with three key benefits. The first is visibility into any potential income changes on the horizon based on their portfolio’s performance. Second, the couple can safely withdraw more from their nestegg at the start of retirement because they are willing to make changes to their spending over time. Finally, the guardrails ensure that they are consistently striking the optimal balance in their retirement income. The upper guardrail ensures that they are maximizing their retirement lifestyle, and avoids leaving too much money under the mattress. While the lower guardrail protects the longevity of their nestegg, and ultimately the stability of their overall retirement plan.

When running an asset projection model on the same portfolio, but this time using a dynamic strategy, we tend to see what the aerospace world would qualify as a controlled descent. The couple is projected to end up with just over half of their starting portfolio, all while experiencing a sustainable and efficient distribution of their hard earned nestegg throughout their retirement.

Embracing A Strategy That Works For You

The underappreciated upside of retirement withdrawal strategies is that they are highly customizable. Unlike Social Security and pension income, our nestegg provides a fantastic amount of flexibility that cannot be mimicked by fixed income sources. Our withdrawal strategy puts us in control of how much income we receive in any given year. Once established, it can be adapted as our health, circumstances, and priorities change.

To arrive at a relatively precise answer for ‘how much we can safely spend in retirement’ we first need to determine our willingness to experience income changes. Someone who is uncomfortable with the idea of having to take an income reduction is likely better off using a static withdrawal strategy that closely mimics the 4% safe withdrawal rate. Others who embrace a dynamic strategy can likely start retirement at a mid-to-high single digit withdrawal rate, assuming they implement effective Guardrails. Understanding the core tradeoffs between these strategies should not only give us a sense for our own preference, but also provide us with a fairly solid answer for how much we can safely spend in retirement.