Unlike the pension generations before us, today most retirees rely on IRA accounts as their primary retirement income source. The money in your IRA is characterized as tax-deferred, meaning you haven’t paid taxes on it yet. A good way to think about tax-deferment is as a business agreement that you have with the US government. Initially, while you’re working the government provides you with a tax break on your IRA contributions by excluding them from your annual taxable income. Then, years later once you’ve entered retirement, your IRA withdrawals are finally taxed as income. Think of it as the government having a lien on your house, except it’s your retirement savings. In theory it’s a pretty good deal, except for one massive variable. We have no way of knowing what the income tax rates are going to be throughout our retirement.

Breaking Down The Income Tax Outlook

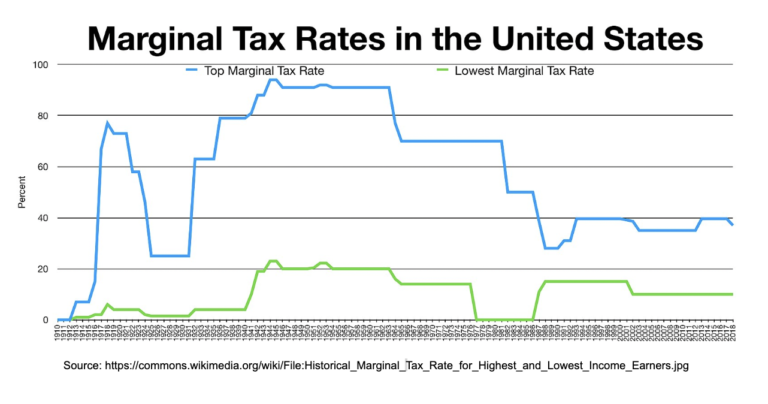

The financial planning world is buzzing with future income tax rate predictions and projections. Predictions are helpful, but they should be taken with a grain of salt. The fact of the matter is that no one actually knows what tax code changes are coming down the pike. The best we can do is look at historical tax rates, and determine the relative attractiveness of where we stand today.

The chart above shows that, starting in 2018, wealthy taxpayers are in a relatively favorable tax environment. In fact, it’s excellent. Additionally, our history would indicate that top tax rates are far more likely to move higher as opposed to lower in the coming decades. This hypothesis is further supported by the exponential increase in government spending and Treasury debt we’ve seen in recent decades. The combination of these circumstances likely means that something’s gotta give. Either the government needs to radically ratchet down its spending, or taxes will have to increase. Many retirees and planners are betting on the latter.

The unsettling nature of the income tax outlook doesn’t bode well for us when it comes to our business agreement with the US government. That government lien on our savings creates a layer of uncertainty and apprehension for many. So how do we get out from under the thumb of the US tax code?

Taking Control With Roth Conversions

Anyone with an IRA has the option to do what is known as a Roth conversion. A Roth conversion is when you strategically take a withdrawal from your IRA to pay the taxes on it now. Then roll that withdrawal into a Roth IRA account. Once the withdrawal is in the Roth account it can be invested and grow tax free indefinitely. That means whether you choose to withdraw it down the line or leave it to heirs, that money will never again be subject to income taxes. Oftentimes conversions are done annually to incrementally move money into your Roth account, while staying within favorable tax brackets. By implementing a Roth conversion strategy you are essentially reducing your exposure to the risk of higher tax rates in the future.

While a Roth conversion acts as a hedge against higher future income tax rates, it’s like any financial strategy – it’s not a sure thing. If instead of rising, income tax rates were to come down throughout your retirement, then Roth conversions become far less attractive. When deciding on a conversion strategy, the best we can do is work with the information we have. As it stands today, many of the current tax brackets are set to increase in 2026 with the sunsetting of the Tax Cuts and Jobs Act. However, the inconvenient truth is that long-term tax rates are unknown and are always subject to change. If you are choosing to operate under the assumption that tax rates are likely to go up, or you simply want more control over the taxation of your retirement assets, then now would be an optimal time to convert IRA money into Roth money.